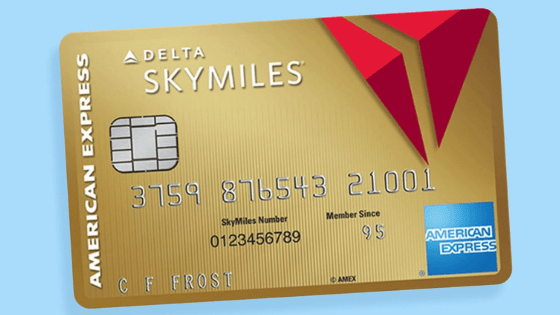

Gold Delta Skymiles Credit Card – Best Airline Credit Cards

Another article about credit cards? Well yes, but this time it is the airline credit card the Gold Delta Skymiles Credit Card. Before you click off the article hear me out. Airline credit cards are a little different than your normal travel credit cards like the Chase Sapphire Preferred or Amex Gold card.

Airline credit cards are different because they serve a specific need, traveling via an airline. This may seem obvious but most people who fly a lot don’t take advantage of these types of cards or their great benefits. To be honest, I’m new to the airline credit card world but I can already tell the Gold Delta Skymiles Credit Card will be a card that stays in my wallet for a while. The main reason? Well during the first years there is no annual fee ($95 after the first year).

Compare that to some cards whose fees are $200 – $600 per year and you have yourself a great deal. Add on top of that a signup bonus of 50,000 miles when you spend $1,000 in the first 3 months and you will be sitting pretty.

Yes, this is my first airline credit card but it will stay in my wallet for at least a year. After that, I’ll need to consider if it’s worth paying the annual fee or if I should downgrade it to a no annual fee card. But for now, let me tell you why I added the Gold Delta Skymiles Credit Card to my wallet and why you may want to as well.

Credit Card Disclaimer

It’s no secret that I love credit cards and the free rewards that come along with them. But I’d also be doing you a disservice by not issuing a warning on the risk you are taking using a credit card. Based on the last census, on average a person in America has $5,700 of credit card debt. Yes, I understand you may not have any but your neighbor maybe tens of thousands of dollars in debt and you don’t even know it. My point is you need to understand how to use a credit card. At minimum know this rule:

Pay off the full amount of your credit card or charge card every single month with no exceptions.

If you follow that one rule then you too can reap the benefits of credit and charge cards. Seriously, I just went to Banff, Canada and the whole trip ended up costing me less than $600. This article isn’t meant to outline all credit card benefits, instead, I’m going to focus on the American Express Gold card. If you want to learn more about credit cards then come back to this fancy table I made just for you after you are done reading here.

The Top 3 Benefits Of The Gold Delta Skymiles Credit Card

1) No Annual Fee

That’s right! For the first year of this card, there is no annual fee. Pair that with how easy it is to get the 50,000 bonus signup and you have the combination for a great card. After the first year the annual fee of $95 does kick in but if you want you can downgrade before then. Did you know you can downgrade or upgrade cards whenever you want? It’s a huge benefit that allows you to not pay annual fees for things you don’t need.

2) First Checked Bag Free

As someone who hates being nickel and dimed by large corporations, this is my favorite benefit of the Delta Skymiles card. First off, I hate checking a bag so if I have to do it I definitely don’t want to pay for it. Having this perk on the card automatically saves me around $60 on a round-trip Delta flight.

This means if you keep the card for over a year and fly once on Delta then you are already almost getting your money worth from the annual fee ($95 – $60 = $35).

3) Earn 2x Delta Skymiles

This is an airline credit card so you better believe there are going to be some perks from the airlines. With the Gold Delta Skymiles Card, you get 2x points on all Delta related purchases. This could be your tickets, the Skymiles club, or in-flight purchases.

If you are a frequent Delta flyer then this is a great benefit for you!

Other Benefits Of The Gold Delta Skymiles Credit Card

20% In-Flight Savings

If you fly Delta frequently and enjoy a nice drink or snack on the plane then be ready to get 20% off all purchases. I realize this isn’t a huge benefit but any money I can get back from someone I’m going to take advantage of.

Car Rental Loss and Damage Insurance

When you pay for a rental car using your Gold Delta card you can waive any insurance the rental company is trying to sell you on. This card ensures that if your car is damaged or stolen that you’ll be covered.

There are quite a few cards out there with this perk but few airline credit cards so again take advantage if you can.

Earn 1x Delta SkyMiles

The last benefit of this card is that you get 1x Delta Skymiles on all other purchases. A Delta Skymile is worth about $.012 a piece so this is similar to getting 1.2% cashback. No, this doesn’t beat the Amex Gold Card (my current favorite travel card) but it does match it not beat most cashback cards.

How To Apply

Are you ready to take action in building your credit and earn awesome rewards at the same time? If so, then apply for the Gold Delta Skymiles Card by clicking the button below. It will take you directly to American Express’ secure site.

The Bottom Line

Is this the best credit card in the world? Absolutely not. But is it one of the top airline credit cards out there? I honestly believe so. The combination of no annual fee, a great sign up bonus, and decent benefits make this a winner in my book.

Like I said earlier, I’m going to keep this card in my wallet for at least a year in order to get the bonus and avoid the annual fee. After that, I’ll have to re-evaluate.

If you are someone who flys Delta consistently like for work then you need to have some sort of Delta Credit Card. You are leaving free benefits out there and you’d be a fool not to get those points.

Related Questions

Below are some common questions that I have come up with regards to the Delta Gold Skymiles Credit Card that I may not have answered above.

1) Does Delta Gold Get Lounge Access?

The short and sweet answer to this is unfortunatley no. As a cardholder, you can access lounges with up to two guests at a discounted price but it is not a part of the card. I think this is a huge miss by Delta because Delta’s Skylounge access is huge for anyone who travels.

2) How Much Is 30,000 or 60,000 Delta Skymiles Worth?

Delta Skymiles have a redemption rate of about $.012/point. This equates to 30,000 points being worth around $360 and 60,000 points $720. Of course, Delta does often have sales where your points can go as far as $.02/point.

3) Is the Delta Gold or Platinum Card Better?

To answer this question you need to think about how often you fly Delta in one given year. The reason being is the Platinum Delta card allows you to earn MQMs which can then get you upgraded on your flights. You need to spend quite a bit to get this benefit otherwise it has little or no value. If you fly occasionally then I would suggest sticking with the Gold Delta card.

If you liked this post then please pin the picture below and if you want to read more articles here are my latest:

- Man’s Search For Meaning and Community

- The Best Way To Change A Habit – Rip The Bandaid Off

- I Need A Physical Challenge… So Let’s Go For A Run

- Positivity And Optimism Is Always The Answer

- Most Financial Advice Is Terrible and Here’s Why