Death Tax – Will Your Beneficiaries Be Stuck With A Big Bill?

Globe Photos/ZUMAPRESS

No matter who you are, where you live, or how you are brought up you will never avoid two things: death and taxes. Benjamin Franklin once said: “In this world, nothing can be said to be certain, except death and taxes”. The crazy thing is even after you die, anything you own has the ability to still be taxed. This is commonly referred to as the death tax.

The death tax is an umbrella term that covers many different specific types of taxes that one’s estate will have to pay after they die. The two I want to focus on today are estate and inheritance tax. People seldom realize that these taxes even exist or have the common theory they are just for the ultra-rich. While there may be some truth in that, you should still understand what they are. Chances are you will have to pay them someday.

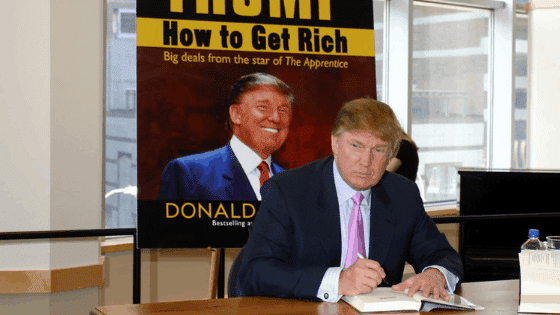

Last week the New York Times released a 14,000-word investigation report into Donald Trump and his siblings. Here is the link to that article: Trump Engaged in Suspect Tax Schemes as He Reaped Riches From His Father. This article is a beast with a ton of great information. If you are a money nerd like I am, I’d highly recommend reading it.

The article covers the last 40 years of Donald’s financial past but the main theme is that he may have avoided taxes. Now, I’m not going to go full political here as that’s not the point of this article. I’d rather present you with the information from the article and you can form your own opinion.

A quick summary is that Donald and his siblings paid only $52.2M of the supposed $550M that they should have paid. They did this by using shell companies, charging fraudulent expenses, and outright avoiding death taxes. This money came from the estate of Donald’s dad, Fred Trump, who was a New York City real estate icon.

With all that at the forefront, I want to explain to you what you need to know about the death tax. Chances are high that none of you reading this article will be inheriting a real estate empire worth billions. Even so, you may have a tax bill on your hand in the future.

Estate Tax

The most common type of death tax that you will hear about is the estate tax. While it is frequently the most talked about, chances are you will never have to pay it. Reason being [is] that the threshold is incredibly high. In December of 2017, Congress passed new tax laws. With these laws, they raised the federal threshold from $5.6M per person to $11.2M. For a couple, these numbers are doubled.

Another reason is that the estate has to pay the estate tax, not the beneficiary. This means that if I died and qualified to pay some type of estate tax then it would come out of my money first and foremost. They calculate how much I’d owe by taking all my assets minus my liabilities.

Assets are pretty straightforward and include any property, cash, and all belongings. This can include anything from art to a car. If it has value, it will be included in your assets. Liabilities can get a little bit messier. The easiest ones to deduct are your mortgage, credit card debt, and any other outstanding loan amounts. You can also deduct medical expenses, funeral cost, and many others. If you need more information on this, please consult a CPA. I’m just trying to give you an idea of how it works.

After you find the difference between these two numbers, you will get your net estate value. You then must take this number minus the federal threshold of $11.2M. For example, if my estate was worth $13M and I subtracted the threshold, I would have $1.8M that will be taxed at a federal level. The last thing you’ll need to do is take this number times 40%, which is the federal flat tax rate. This will give you a tax bill of approximately $720,000.

The estate tax is fairly straightforward at the federal level but of course, we have to complicate it. We are talking about taxes after all. After the federal level then comes state estate tax. If you are like me and live in Kansas, then you don’t have to worry about this as we don’t have any. There are however a dozen or so states that do levy a state-level estate tax. Going into each one has little value to most of you so here’s a link to that list and a short explanation.

Inheritance Tax

Unlike the estate tax, inheritance tax can possibly be much more complicated. I use the term ‘can possibly’ here on purpose because if you are in a state with inheritance tax then brace yourself. For most, you will never have to worry about it. This is because, at the federal level, there is no inheritance tax. Moreover, there are only six states that have an inheritance tax.

This type of tax can be extremely complicated because there can be many more people involved. A spouse, a child, a grandchild. All of these people can be taxed at different rates. For instance, a spouse may be tax-free but my sister may be charged a 15% tax. This is when you must know your state’s laws. If you live in Maryland, New Jersey, Pennsylvania, Kentucky, Iowa, or Nebraska then I’m sorry, you are the unlucky ones.

Wrapping it Up

In late 2017 when politicians were working on the new tax bill, they bragged how you would be able to file your taxes on a postcard. First off, if you believed this you’re crazy. Secondly, death taxes are just another thing you need to consider when filing your taxes. Heaven forbid it isn’t an every year thing, but it is going to happen.

Now, did Donald Trump illegally withhold taxes from the government? Most likely. Did he also use legal loopholes to save as much as he could on his tax bill? Absolutely. It’s never been easier to pay a tax professional to do this for you. The added complexity of each state having their own laws actually makes it easier to not pay taxes.

Tax laws are changing all the time. When this alleged fraud happened the estate tax rate was 55% vs the 40% today. This rate is sure to change as well. In fact, main components of the new tax bill of late 2017 are only law until 2025 where they will be revisited.

Lastly, inheritance and estate tax are the two most common types of death taxes. There is also the gift, income, and generation-skipping transfer taxes. These are not as common, yet still important, and will be covered later.

In the end, all we can do is worry about ourselves and do what is legal. As always, consult a tax professional.