5 Steps To Improve Your Credit Score Without A Job

We’ve all heard that improving your credit score is an important part of your financial story but can you do it without a job? The answer is yes, but it will be a challenge. This year has been tough and some of you reading this, maybe even you, have been put out of a job. You’re not alone but that doesn’t mean you can’t take some positive steps for your finances. In this article, I want to help you create a plan to move forward in your financial well-being in spite of your circumstances.

We all know the world is not normal and things are hard right now. But we’re in the business of improving ourselves even when it’s difficult. This situation could give you the time to focus on your financial priorities (I wrote about this in an earlier blog) and actually improve your credit score! Let’s go through a few ways you can improve your credit score, even without a job.

1) Become an Authorized User

Did you know your credit score could improve when someone else uses their credit card and pays their card on time? All they have to do is add you as an authorized user on that card. If you are an authorized user on someone else’s account, their activity is your activity.

Each month the credit card company will report their activity on YOUR credit report. This has got to be in the “too good to be true” category since you don’t need to use the card yourself! TIP: Make a list of all the family members and friends you know and cross out anyone who might not pay their cards on time. This is a big commitment and you should only do this with someone you trust. You don’t want late payments on your credit score and money can be a sensitive issue.

2) Fix Your Credit Reports

According to the Federal Trade Commission (FTC), one in 5 people (that’s 44 million of us!) have inaccurate credit reports that could lower your credit score. You could spend a lifetime trying to repair a bad mark on your credit so you definitely don’t want something on there that you didn’t do. Here’s a video from the FTC that explains how you can obtain your credit reports from each of the three credit bureaus and exactly what you should do if you find an error. Here’s the website mentioned in the video where you can order your credit reports.

Usually, you’re only entitled to free reports once a year, but COVID has given you a little known perk. Everyone is now eligible to get free weekly online credit reports until April 2021. You are also entitled to six free credit reports every 12 months from Equifax through December 2026. You can access these free reports online at AnnualCreditReport.com

3) Leverage Your Rent and Utility Bills

Even though you don’t have a job right now, you’re probably still paying your rent and utilities. Each of those payments can be used to prove that you pay your bills, thus improving your credit. Ask your landlord or property manager if they will report your rent payments to the credit bureaus. If not, you can sign up for a service that will report for you for a small fee. And yes, there’s at least one app for that! Our friends at nerdwallet.com have put together a list of companies that you can also use.

4) Use a Low-Limit, No Fee, Credit Card

I wrote a whole blog article on the benefits and risks of using credit cards to get rewards and build credit. I even posted a video on youtube (make sure to subscribe!) that explains exactly which card you should get. By using a credit card and then paying off the balance, your credit score will improve. With credit cards, you have to be cautious. I only recommend using credit cards to buy things that you would already be buying anyway. Credit cards can be dangerous if you allow interest to build up. As I explained in the video and many blog posts, if you use a credit card you MUST follow the golden rule:

Pay off your statement balance in full each month, every month, without fail.

Here’s a link to apply for the Chase Freedom Unlimited card I mention in the video. If your credit score isn’t high enough to get this card, that’s no problem. You may want to consider this excellent list of secured credit cards instead.

5) Find your “Why”- Create a Goal

I saved the most important step for last. The four steps above are simple, but they aren’t easy. They all require you to consciously make good choices and ask for help. Friedrich Nietzsche wrote: “He who has a why to live for, can bear any low”. In other words, if you have a goal (the “why”) that requires you to have good credit, you’ll have the motivation and discipline to implement and follow the steps (the “how”).

You must sit down and think through this step. Think about what your life will look like in 5 years, 10, years, or 15 years. If everything goes perfectly, what’s your dream job? How do you use your strengths and passions to make money? What experiences do you have? What types of things do you want to own? Write down all those thoughts. Do you want to own a car or a home? Do you want to have a family? Do you want to start a business?

All of those things require you to have a good credit score. You have now discovered your “why”. The next step is to create a plan or a budget to reach your goals. We can do this together. With my financial coaching service, we can assess your situation and I will help you make a plan. I’ll also be your accountability partner and check back in with you regularly to see if you’re meeting your goals. You don’t have to do it alone.

The Bottom Line

The world is wild right now and we’re all dealing with personal, social, health, and financial situations that we never expected. We can’t let this pandemic take everything away from us though. There is always something to be done that can improve our lives.

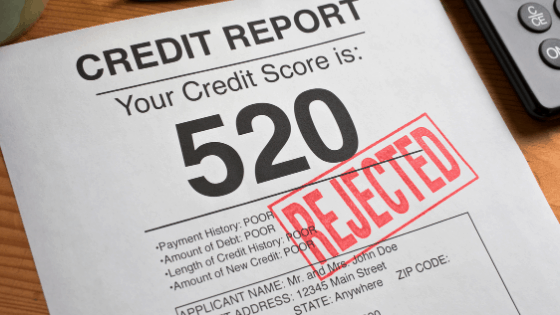

A Credit score is one of those basics of finance that you must have a good handle on. Your credit score can open (or close) many doors. Bad credit can haunt you for a lifetime and cost you thousands down the road. so it’s important to build good habits now. Improving your credit score without a job is an impressive feat and no small challenge. With some persistence, it is something you can do.