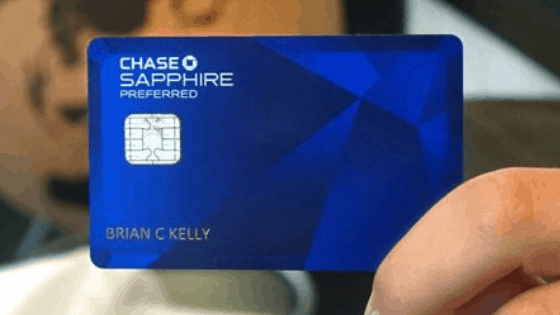

Why You NEED To Add The Chase Sapphire Preferred To Your Wallet

Most people think that having one credit card is unnecessary so when I suggest people have two, their heads explode. Yes, I think you should have at least two. In fact, I have six now and sometime this spring I’ll add my seventh. A little ridiculous? M

The Chase Sapphire Preferred is one of the best travel and rewards cards on the market. It gives you 2x points on any expenses related to dining out or traveling. Moreover, you get 50,000 bonus points just for signing up. That’s equivalent to $625 in travel credits when you redeem them through Chase Ultimate Rewards. The annual fee is $0 for the first year and then $95 after that but don’t let that scare you. I’ll explain why it’s worth it.

When I first got this card, all I wanted to do was travel and pay for it 100% with rewards. I knew this was possible but I had no idea how easy it was. This card opened my eyes to the possibilities.

Credit Card Disclaimer

Just like I started my article: Why The Chase Freedom Unlimited Should Be Your First Credit Card, I need to give you my typical credit card disclaimer. Credit card debt is a huge problem in this country. Based on the last census, on average a person in America has $5,700 of it. Yes, I understand you may not have any but your neighbor may be tens of thousands of dollars in debt and you don’t even know it. My point is you need to understand how to use a credit card. At minimum know this rule:

Pay off the full amount every single month with no exception.

If you follow that one rule, you will be fine. Hopefully, I haven’t totally scared you off yet because there are some great benefits to credit cards. This article isn’t meant to outline all benefits, instead, I’m going to focus just on the Chase Sapphire Preferred. If you want to learn more about that, read my past article It’s Time For You To Get A Credit Card.

Top 3 Benefits Of This Card

Like all credit cards, the Chase Sapphire Preferred has some core benefits that you should know about. All too often, people just use their credit card and pay it off. Which is the right way to use it, but they forget all about the

1. Signing Bonus

The signing bonus is what makes this card so worth it to me. When you spend $4,000 in the first three months ($1,333/month) you automatically get 50,000 reward points credited to your Chase account. These are worth $625, or about six and a half years of the yearly annual payment of $95. Also, that annual payment doesn’t actually start till the second year of having the card. Your first credit card was most likely all about cash back. While that is

2. 2x Points

This card’s main focus is to help people who travel and want to travel more earn points. You will earn 2x points on all travel related expenses. For example, when you go to the grocery store, all you’re going to get is a one to one ratio. For every dollar you spend, you get one point. But when you buy a $500 flight, you will earn one thousand points. Anything related to travel as well as dining out (easy one there) gets you double points. Not a bad deal.

3. 25% More in Travel Redemption

Once you’ve earned all the points, you need to use them. While points will never expire they aren’t doing you any good just sitting there. With the Chase Sapphire Preferred your points are worth 25% more when redeemed for travel-related expenses. This includes any airfare, hotels, car rentals, or even cruises. What this means is if you have 100,000 points saved up, they are worth just over $1,250 in credit!

Other Benefits

These three aren’t the only benefits of this card. Here is a list of others that you may not need every day but when you do they could be a lifesaver.

- Trip Cancellation/Trip Interruption Insurance – If your trip has a hiccup, such as you get sick or flights get canceled, then you will get reimbursed up to $10,000. This covers everything, not just your flights.

- Car Rental Insurance – This card allows you to decline the rental car insurance and instead covers you for theft and collision. You are covered in the US and abroad up to the actual amount of the car.

- Baggage Delay Insurance – If your baggage is lost and you need some basic clothes or toiletries, Chase will take care of you. For 5 days, you will get a $100 credit until your bag reaches you.

- Lost Luggage Reimbursement – If your baggage actually does get lost, then Chase will cover you for up to $3,000 per person! Yes, per person. That means the whole family is covered.

- No Foreign Transaction Fees – This card is for the traveler so why not skip the foreign transaction fees? If you spend $2500 abroad, you’d avoid about $75 in transaction fees.

- Roadside Dispatch – Chase offers a 24-hour hotline that you can call for roadside assistance. Instead of paying a crazy fee, you just pay a flat fee. This includes jumpstarting, tire change, gas, locksmith services, and evening towing.

Why Have Two Credit Cards?

While the focus of this article is on the Chase Sapphire Preferred I want to explain why it’s a good idea to have two credit cards. First off, if it’s not already ingrained in your head, you need to be able to manage them no matter what. Simply pay them off in full every single month, with no exception.

The main reason I now have six credit cards is to get my credit utilization rate as low as possible. Credit utilization sounds complicated but it is simply the percentage of available credit you use per month. For example, if you have a credit card with a $1000 monthly limit and you spend $500 per month then your credit utilization rate is 50%.

Currently, I have around a $50,000 monthly credit limit between all of my cards. I only spend on average $1500 per month. So while you may have the 50% credit utilization rate as described above, I only have a 3% usage rate. That’s a huge difference. This is important because your utilization rate is an indicator of how likely you are to push the boundaries of your credit limit.

Credit utilization is a major factor in calculating your credit score. If you want to learn more about it then visit one of my first posts: Save Yourself Thousands by Understanding Your Credit Score. It goes over everything you need to know about credit scores and why it’s important.

What Did I Do With My First Card?

When people hear you are going to get a second credit card, they think you are crazy. They immediately jump to the conclusion that you are going to go into thousands of dollars of credit card debt and end up on the street. That simply isn’t true. You could have 50 credit cards and it wouldn’t matter. All that matters is you control your spending and stay within your means.

When I got the Chase Sapphire Preferred the first thing I did was change all of my automatic bill payments over to that card. I waited a month to make sure nothing was getting charged to my Chase Freedom Unlimited card and then I simply stuck it in my filing cabinet. It has literally been sitting there for years.

It’s important to note that I didn’t close the card. The reason I didn’t close it is was for that credit utilization rate. I need to keep it open to keep that line of credit so my utilization rate will be lower. Just because it’s open doesn’t mean I have to use it though!

How To Apply

Are you ready to take action in building your credit and earn awesome rewards at the same time? If so, then apply by clicking on the button below. It will take you directly to Chase’s secure site.

The Bottom Line

Hopefully, by now I’ve started to make you more comfortable with credit cards and the idea of using them. They really are a great tool when used correctly. The Chase Sapphire Preferred has allowed me to travel quite a bit and it will continue to in the future. Just by signing up you get over $600 in value which will continue to grow in the future as you earn reward points. This alone makes the $95 annual fee worth it to me.

If you liked this post then please pin the picture below and if you want to read more articles here are my latest:

- Man’s Search For Meaning and Community

- The Best Way To Change A Habit – Rip The Bandaid Off

- I Need A Physical Challenge… So Let’s Go For A Run

- Positivity And Optimism Is Always The Answer

- Most Financial Advice Is Terrible and Here’s Why

Disclosure: There may be some affiliate links below and I may receive commissions for purchases made through links in this post. Any link is something that I’ve personally used and recommend. All proceeds go back into YD&NB to help keep creating content like this.