Why You Need The (Amex) American Express Gold Card

The American Express Gold Card is a card I added to my wallet over six months ago and I’m going to be honest, I love it. I have more than my fair share of cards but I seriously mean it. This card is one of the top credit/charge card options out there.

Why do you need the (Amex) American Express Gold Card?

The American Express Gold Card offers 50,000 Membership Reward Points when you spend $2,000 in the first three months. Additionally, you earn 4x points when you spend at restaurants and supermarkets. Add on top of that a $120 dining and $100 airline credit and you are already negating the $250 annual fee.

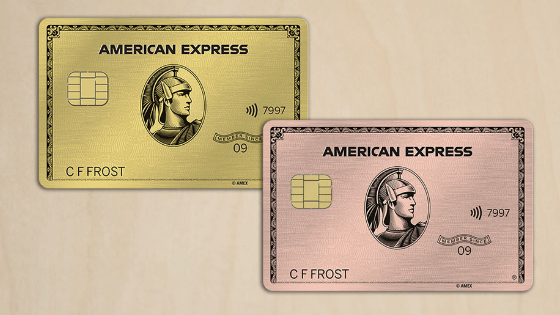

My favorite thing about the American Express Gold Card? Well, this may seem obvious but the looks. I’m not a materialistic guy, but having a gold, metal card just feels good. Chase made the metal credit cards a thing with the Chase Sapphire Reserve and I’m so happy they did. While they are both metal cards, the Amex Gold Card is much more impressive when it comes to the look.

In the end, looks don’t matter though. You need to know what the card can do for you and why you should get the American Express Gold Card. Enough messing around; let’s get into the details.

Credit Card Disclaimer

It’s no secret that I love credit cards and the free rewards that come along with them. But I’d also be doing you a disservice by not issuing a warning on the risk you are taking using a credit card. Based on the last census, on average a person in America has $5,700 of credit card debt. Yes, I understand you may not have any but your neighbor may be tens of thousands of dollars in debt and you don’t even know it. My point is you need to understand how to use a credit card. At minimum know this rule:

Pay off the full amount of your credit card or charge card every single month with no exceptions.

If you follow that one rule then you too can reap the benefits of credit and charge cards. Seriously, I just went to Banff, Canada and the whole trip ended up costing me less than $600. This article isn’t meant to outline all credit card benefits, instead, I’m going to focus on the American Express Gold card. If you want to learn more about credit cards then come back to this fancy table I made just for you after you are done reading here.

Top 3 Benefits Of The American Express Gold Card

1) The Membership Rewards Sign Up Bonus

As a credit card aficionado, I love playing the signup bonus game and the Amex Gold Card is no exception. When you spend $2,000 in the first three months ($666/month) you automatically get 50,000 Membership Reward Points to your Amex account.

At a value of $.02 per point you already have $1,000 worth of value. Remember the $250 annual fee I talked about earlier? Well, you just covered it for the next four years and I haven’t even got to the good parts!

2) 4x Membership Reward Points

Anytime I can earn points faster, I’m going to take advantage of that. The American Express Gold Card is unique because it allows me to earn more points on the things I spend the most on; restaurants and groceries.

When you swipe or insert your card at any US supermarket you automatically earn 4x Membership Reward Points. Last year I spent over $1,500 on groceries so that means I would have earned 6,000 points. On top of that, you also get 4x points when you use your card at restaurants. Again, last year I spent over $2,500 which means that would have been an extra 10,000 points.

All in all, I would have earned 16,000 points which equals a value of roughly $325. That’s enough for a round trip flight to almost anywhere in the US! The important thing to note here is that I would have earned points without buying anything extra. You don’t have to buy luxurious trips or items for them to reward you. Those points would have been earned on frozen pizza, pop-tarts, and diet mountain dew.

3) Amex Offers & Benefits

Amex gives you certain items you can add to your card each month. I really have no idea the thinking behind it but some offers are for a month, some until the end of the year, and there are even others which seem to have a random date attached to them.

This benefit of the American Express Gold Card is one that you don’t often hear about. To be honest it reminds me a lot of the quarterly additions you can make to your Chase Freedom except this deals with points. Points are obviously my preferred language. Yes, cashback cards are great but I’m all about the points.

Pictured above is the one I recently added to my card. If you read through it, you can see that it allows me to get 1,500 points when I spend $75 on Amazon. Now I don’t know about you, but I’m a huge fan of shopping on Amazon and having a couple of months to do it is no problem.

These 1,500 points equal about $30 worth of value (1,500 * $.02). By simply hitting a button and adding on this offer, essentially I have given myself a 40% off coupon. This is inferring I’m going to spend that $75 no matter what and it isn’t an additional expense for no reason. To be honest, I’ll probably buy dog food or something. Hank needs to eat and he’s spoiled.

Imagine if you have multiple offers like this at stores and sites where you’re already spending your money. While this seems like a small perk, it can add up and I’m a firm believer in playing the small game over time.

Other Benefits Of The American Express Gold Card

The Amex gold card has other cool benefits besides sign up bonuses and point multipliers. We’d be here all day if I tried to explain them all to you but I am going to tell you about a couple of my favorites. If you want to read the full list, then click the “Learn more” button directly above or near the end of this article. If you want to go directly to Amex’s site then click here.

$120 Dining Credit

The first offer I saw that got me excited was the $120 dining credit. Spoiler alert, to my dismay it isn’t as good of an offer as you’d believe from the name of it. While you do get $120 towards dining, it is very specific on what you can spend on and is spread out evenly each month for a year ($10/month).

This is unlike the Chase Saphire Reserve which has a “Travel Credit” that is applicable to almost anything that involves getting from point A to point B. With the American Express Gold Card dining credit, you get to use $10 per month on Grubhub, Seamless, Boxed, and a couple of others. Unfortunately for me, I don’t use those services often and the other restaurants listed aren’t in my area.

If you are a big Grubhub user for example then you almost cut the cost of the annual fee in half by using this offer. It’s a great add on perk in the right situation.

$100 Airline Credit

There is another statement credit that the Amex Gold offers and that is towards airline expenses. This used to be an amazing credit because you could simply buy a $100 airline gift card once a year and put that towards a flight down the road. Of course, the companies caught on to this and now it is no longer available, sad I know.

Not to worry though, this credit still comes in quite handy when you’re traveling.

Want to check a bag? This credit will apply.

Want to upgrade your seat? This credit will apply.

Want to eat a full meal and get a little buzz on the plane? You’re in luck, this credit still applies.

While the ‘hack’ of just buying a gift card is no more, this bonus offer is still a great deal especially if you use airline travel frequently.

No Foreign Transaction Fees

This is probably one of my favorite perks on any credit or charge card and it seems so minuscule. It probably stems from my deep-seated hatred for paying any sort of fees. Being able to swipe and spend my money how I want, no matter where I am in the world is such a simple pleasure.

If I would have used my debit card while traveling to Europe I would have paid over $300 in foreign transaction fees. That’s just ridiculous. You could take cash, get your dollars exchanged for your destination’s currency, and hope you have enough. OR you can literally just take your Amex gold with you and swipe it. Seems like a pretty easy choice to me.

Baggage Insurance Plan

The Amex gold leans a lot of its benefits towards travel and having a baggage insurance plan is a big part of that. I have a massive irrational fear about checking my bags and losing them, but this perk helps ease my mind (just a bit). This isn’t just for flights but also on a train, bus, or even a cruise ship.

When you purchase your ticket using your card, you are covered up to $1,250 for a carry-on bag and up to $500 for a checked bag. Your belongings are covered whether it’s lost, damaged, or obviously stolen. So put your mind at ease fellow traveler, this card has your back.

Car Rental Loss and Damage Insurance

This perk has become pretty popular on travel cards and for good reason. Paying a rental car company for insurance is for suckers and is often overpriced. In the last two years alone, I’ve waived their terrible insurance four times. This perk alone makes the annual fee worth it.

If you rent a car, the Amex gold provides insurance to cover if the car is damaged or stolen. This doesn’t include liability coverage though!

Warning: there are certain exclusions and restriction so always read the fine print or reach out to American Express to double-check before your trip. Also, vehicles in Italy, New Zealand, and Australia aren’t covered. (Weird, I know. Just do your research.)

How To Apply

Are you ready to take action in building your credit and earn awesome rewards at the same time? If so, then apply for the American Express Gold Card by clicking the button below. It will take you directly to American Express’ secure site.

The Bottom Line

If you enjoy getting things for free by just spending like you normally do, then I would highly suggest adding the American Express Gold Card to your wallet. As someone who has almost ten credit/charge cards now, I can honestly say this card is in my top 3. From the ability to add on offers, to the high exchange rate of points to travel dollars, it’s just a good card.

A lot of people are scared off by cards having an annual fee, but I hope after reading this article you understand that the fee pays for itself multiple times over. Especially if you take advantage of all the perks that are offered.

As always if you have questions reach out to me. The easiest way is via Twitter or you can go through the Contact Me tab.

Thanks for reading!

If you liked this post then please pin the picture below and if you want to read more articles here are my latest:

- Man’s Search For Meaning and Community

- The Best Way To Change A Habit – Rip The Bandaid Off

- I Need A Physical Challenge… So Let’s Go For A Run

- Positivity And Optimism Is Always The Answer

- Most Financial Advice Is Terrible and Here’s Why

Disclosure: There are some affiliate links in this article and I may receive commissions for purchases made through links in this post. See my full disclosure here.